Dear Reader,

How would you like to close out four winners like this in a single day?

SPDR Oil & Gas ETF (XOP)... +36.9%

Antero Midstream Corp (AM)... +102%

MPLX LP (MPLX)... +93%

Roche Holdings (RHHBY)... +28%

That's exactly what readers of Fry's Investment Report had the chance to do on August 5th.

But today, you don't need to be a paid member to get 7 free trade ideas straight from Futurist and Stock Analyst, Eric Fry.

He's released them all in a new broadcast called "Sell This, Buy That."

These calls are a little contrarian... I'll be the first to admit that.

But if you're open to viewing the markets through a different lens, here's a quick preview of what you'll see Eric recommending today when you stream his video.

SELL: Amazon (AMZN)

BUY: A little-known e-commerce company that's more like "buying Amazon in 2005."

SELL: Bank of America (BAC)

BUY: A fintech platform stealing away millions of traditional banking customers.

SELL: Tesla (TSLA)

BUY: A robotics startup already miles ahead of Tesla in the AI robotics race.

Each of these trade ideas comes with the full name, ticker, and analysis – at no cost.

Eric will also give you details on an exciting alternative to Nvidia.

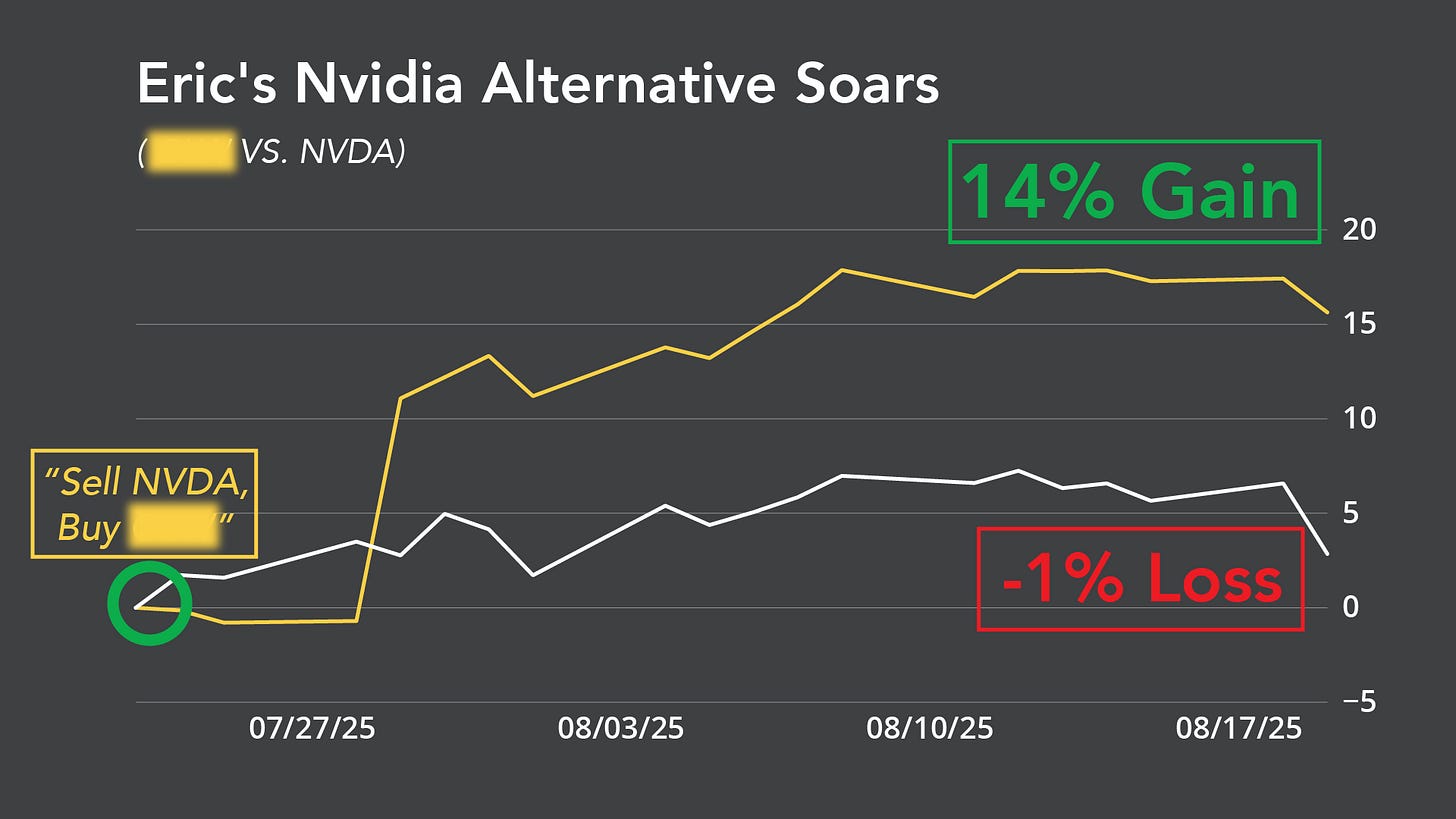

It's a stock that's been crushing Nvidia over the last 30 days since Eric went live with his controversial "Sell Nvidia, Buy XXXXX" recommendation.

Eric has never given away this much research for free before.

Watch now so you can act on these recommendations while they're still cheap.

Sincerely,

Jeff Remsburg

Editor, InvestorPlace Digest

The contrarian approach of selling market leaders and buying smaller alternatives is intriguing, but I'd be cautious about timing. The example of closing four winners in one day is cherry-picking a specific moment - what matters more is the overall strategy's consistency over time. The 'Sell Nvidia, Buy XXXXX' recommendation is interesting, but context matters: is this alternative truly ahead in fundametals, or just enjoying a short-term momentum surge? I appreciate the willingness to challenge conventional wisdom, but contrarian investing requires deep analysis beyond simply identifying smaller competitors. The Amazon 2005 comparison is compelling if the company has similar moats.